What’s the Value of 143 Euros in US Dollars?

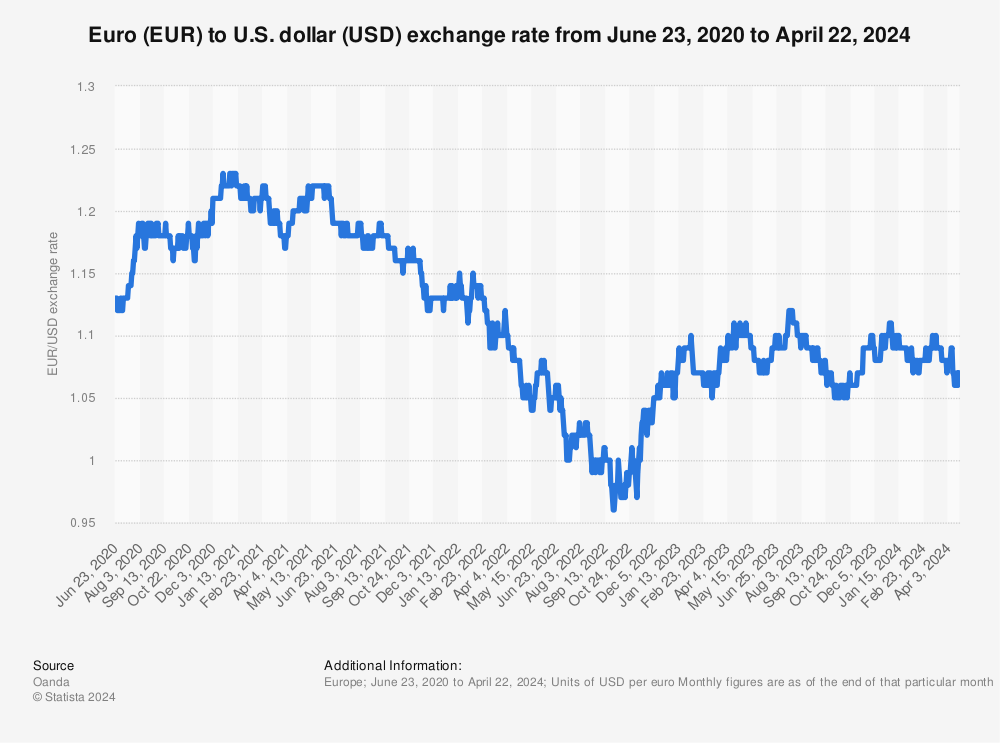

When planning a trip to Europe or making an online purchase from a European retailer, understanding exchange rates is crucial. One common query that often arises is: what is the value of 143 euros in US dollars? This question is particularly relevant for individuals who need to convert euros to dollars for international transactions. The importance of understanding exchange rates lies in its impact on the cost of goods and services. A slight fluctuation in exchange rates can result in significant savings or losses. For instance, if you’re planning to buy a product priced at 143 euros, knowing the current exchange rate can help you determine the exact cost in US dollars. In this article, we will explore the world of exchange rates, providing you with a comprehensive guide to converting euros to dollars and understanding the factors that influence exchange rates.

How to Convert Euros to Dollars: A Step-by-Step Guide

Converting euros to dollars is a straightforward process that can be done using a variety of methods. To convert 143 euros to dollars, you’ll need to know the current exchange rate. As of now, the exchange rate is approximately 1 EUR = 1.12 USD. Using this rate, we can calculate the value of 143 euros in dollars: 143 EUR x 1.12 USD/EUR = 160.16 USD. There are several tools available to help you with this conversion, including online calculators, mobile apps, and currency conversion websites. One popular option is XE.com, a reliable and user-friendly platform that provides up-to-date exchange rates and a convenient conversion tool. Simply enter the amount you want to convert, select the currencies, and the tool will do the rest. With these simple steps, you can easily convert 143 euros to dollars and stay on top of your international transactions.

The Impact of Exchange Rates on International Transactions

Exchange rates play a crucial role in international transactions, affecting the cost of goods and services for individuals and businesses alike. When converting 143 euros to dollars, a small change in the exchange rate can result in significant savings or losses. For instance, if the exchange rate increases by 1%, the value of 143 euros in dollars would rise from 160.16 USD to 161.76 USD, resulting in an additional 1.6 USD cost. This fluctuation can have a substantial impact on online purchases, travel, and business deals. For example, a European company exporting goods to the US may see a decrease in revenue if the exchange rate favors the dollar, making their products more expensive for American customers. On the other hand, an American tourist traveling to Europe may benefit from a favorable exchange rate, allowing them to purchase more goods and services with their dollars. Understanding how exchange rates affect international transactions is essential for making informed decisions and minimizing potential losses.

Why Exchange Rates Fluctuate: Understanding the Factors

Exchange rates are not fixed and can fluctuate constantly due to various economic, political, and market factors. Understanding these factors is crucial for individuals and businesses involved in international transactions, such as converting 143 euros to dollars. One of the primary factors influencing exchange rates is economic indicators, including inflation rates, interest rates, and GDP growth. For instance, a country with a high inflation rate may see its currency depreciate in value, making imports more expensive. Political events, such as elections, trade agreements, and geopolitical tensions, can also impact exchange rates. The Brexit referendum in 2016, for example, led to a significant depreciation of the British pound against the US dollar. Supply and demand also play a critical role in shaping exchange rates. If there is a high demand for a particular currency, its value will appreciate, and vice versa. Additionally, central banks’ monetary policies, such as quantitative easing or interest rate hikes, can influence exchange rates. By understanding these factors, individuals and businesses can better navigate the complexities of international transactions and make informed decisions when converting currencies, such as 143 euros to dollars.

Using Currency Conversion Tools: A Review of Popular Options

When converting 143 euros to dollars, it’s essential to have a reliable and accurate currency conversion tool. There are numerous options available, each with its unique features, advantages, and disadvantages. Online calculators, such as XE.com or Oanda.com, provide instant conversions and often include historical exchange rate data. Mobile apps, like Currency Converter or Exchange Rate Calculator, offer convenience and portability, allowing users to convert currencies on-the-go. Travel websites, such as Expedia or TripAdvisor, often include built-in currency converters, making it easier to plan international trips. When choosing a currency conversion tool, consider factors such as accuracy, ease of use, and additional features, such as currency charts or news. Some popular tools also provide real-time exchange rate updates, ensuring that users have the most up-to-date information when converting currencies, including 143 euros to dollars. By selecting the right tool, individuals and businesses can simplify the currency conversion process and make informed decisions when engaging in international transactions.

Managing Currency Risk: Strategies for International Businesses

International businesses engaging in cross-border transactions, such as converting 143 euros to dollars, face significant currency risk. Currency fluctuations can impact revenue, profitability, and even the viability of a business. To mitigate this risk, businesses can employ various strategies. Hedging, for instance, involves taking positions in the foreign exchange market to offset potential losses or gains. Forward contracts, which involve agreeing to exchange currencies at a fixed rate on a specific date, can also help manage currency risk. Currency diversification, where a business maintains a portfolio of different currencies, can reduce exposure to any one currency’s fluctuations. Additionally, businesses can use options and swaps to manage currency risk. By understanding these strategies and implementing them effectively, international businesses can minimize the impact of exchange rate fluctuations on their operations and ensure that they remain competitive in the global market.

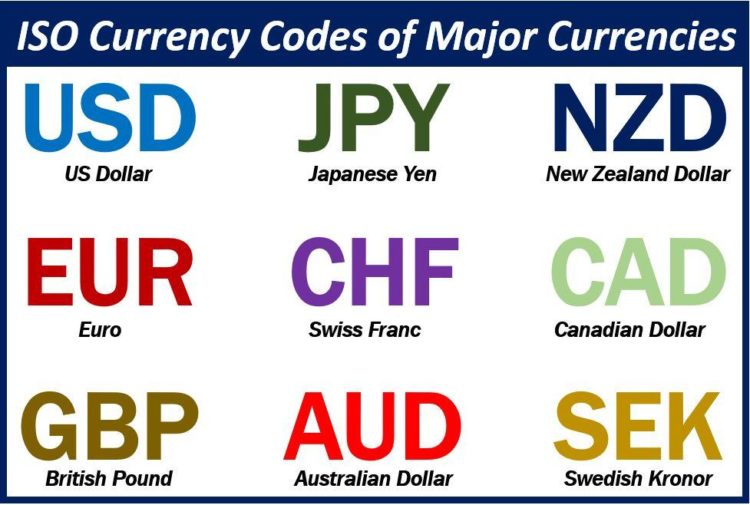

Understanding Currency Codes and Symbols

When dealing with international transactions, such as converting 143 euros to dollars, it’s essential to understand the meaning and usage of currency codes and symbols. Currency codes, like EUR for euros and USD for US dollars, are standardized three-letter codes used to identify currencies in international transactions. These codes are maintained by the International Organization for Standardization (ISO) and are widely used in banking, finance, and commerce. Currency symbols, on the other hand, are the graphical representations of currencies, such as € for euros and $ for US dollars. These symbols are often used in conjunction with currency codes to provide a clear and concise way to represent currencies. For instance, when converting 143 euros to dollars, the currency code EUR and symbol € would be used to represent the euro, while the currency code USD and symbol $ would be used to represent the US dollar. Understanding currency codes and symbols is crucial for accurate and efficient international transactions, and can help individuals and businesses navigate the complexities of global trade.

Staying Up-to-Date with Exchange Rates: Tips and Resources

To make informed decisions when converting 143 euros to dollars or engaging in other international transactions, it’s essential to stay up-to-date with the latest exchange rates. One way to do this is by setting up rate alerts, which can be done through various online currency conversion tools or mobile apps. These alerts will notify you when the exchange rate reaches a certain level, allowing you to take advantage of favorable rates. Following financial news and market trends is also crucial, as exchange rates can be affected by economic indicators, political events, and other factors. Additionally, using currency tracking apps or websites can provide real-time exchange rate information, enabling you to make informed decisions quickly. By staying informed about exchange rates, individuals and businesses can minimize the impact of currency fluctuations and maximize their returns. Whether you’re an international traveler, online shopper, or business owner, staying up-to-date with exchange rates is crucial for navigating the complexities of global trade.