Understanding the Exchange Rate: Quid to Dollars Explained

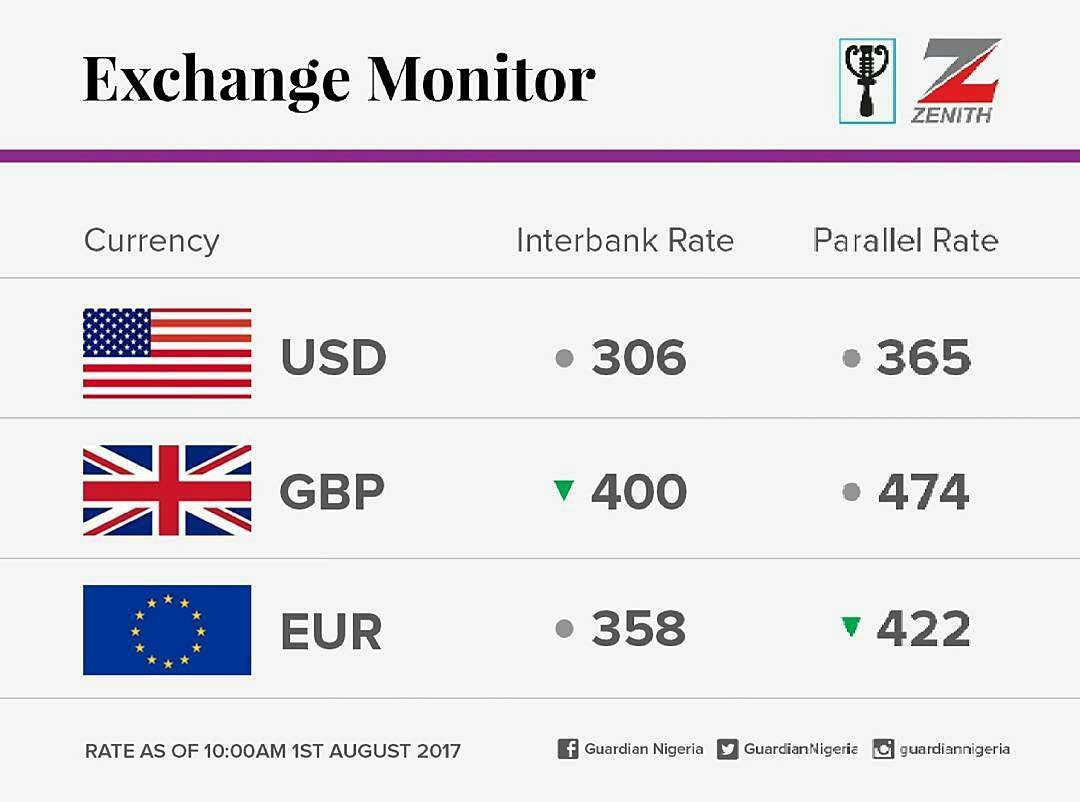

Exchange rates are a crucial aspect of international trade and finance, allowing individuals and businesses to convert one currency into another. The exchange rate between British Pounds (GBP) and US Dollars (USD) is particularly significant, given the economic ties between the two countries. Currently, the exchange rate is approximately 1 GBP = 1.31 USD, although this rate can fluctuate constantly due to various market and economic factors.

To understand the exchange rate, it’s essential to recognize that it’s determined by the foreign exchange market, where individuals, businesses, and institutions trade currencies. The exchange rate is influenced by supply and demand, with the value of one currency relative to another being determined by the market forces. For instance, if there’s a high demand for USD and a low supply of GBP, the value of the Pound may decrease relative to the Dollar.

When converting 350 quid to dollars, it’s essential to consider the current exchange rate to get an accurate conversion. Using the current rate of 1 GBP = 1.31 USD, we can calculate the conversion as follows: 350 GBP x 1.31 USD/GBP = approximately 458.50 USD. This calculation provides a rough estimate, and the actual conversion may vary depending on the specific conversion method and any associated fees.

Understanding the exchange rate is crucial for individuals and businesses that engage in international transactions. By grasping the concept of exchange rates and how they fluctuate, you can make informed decisions when converting currencies, including converting 350 quid to dollars.

How to Convert 350 Quid to Dollars: A Step-by-Step Guide

Converting 350 quid to dollars is a straightforward process that can be completed in a few simple steps. To illustrate the calculation, let’s use the current exchange rate of 1 GBP = 1.31 USD.

Step 1: Determine the amount of GBP you want to convert. In this case, we’re converting 350 GBP.

Step 2: Check the current exchange rate. You can find the latest exchange rates on websites like XE or Oanda, or by contacting your bank.

Step 3: Multiply the amount of GBP by the exchange rate. Using the current rate, the calculation would be: 350 GBP x 1.31 USD/GBP = approximately 458.50 USD.

Step 4: Consider any fees associated with the conversion. Depending on the method you choose, there may be fees for converting currency, such as commission fees or transfer fees.

For example, if you’re using a bank to convert 350 quid to dollars, you may be charged a commission fee of 1-2% of the total amount. This would add an additional 4.58-9.17 USD to the total cost, making the final amount approximately 463.08-467.67 USD.

Alternatively, you can use online currency converters, which often offer competitive exchange rates and lower fees. Some popular online tools include XE, Oanda, and TransferWise.

By following these simple steps, you can easily convert 350 quid to dollars and get the best possible exchange rate.

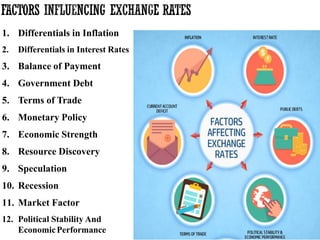

Factors Affecting Exchange Rates: Why Rates Change

Exchange rates are influenced by a complex array of factors, including economic indicators, political events, and market sentiment. Understanding these factors is crucial for anyone looking to convert 350 quid to dollars, as they can significantly impact the value of the Pound against the Dollar.

Economic indicators, such as GDP growth, inflation rates, and interest rates, play a significant role in determining exchange rates. For example, if the UK’s economy is growing faster than the US economy, the value of the Pound may increase relative to the Dollar. Conversely, if the US economy is experiencing a period of high growth, the value of the Dollar may increase relative to the Pound.

Political events, such as elections, trade agreements, and policy changes, can also impact exchange rates. For instance, if the UK and US were to negotiate a new trade agreement, the value of the Pound may increase relative to the Dollar. On the other hand, if there were to be a change in government in either country, the value of the Pound or Dollar may fluctuate.

Market sentiment, including investor attitudes and expectations, can also influence exchange rates. If investors are optimistic about the UK’s economic prospects, they may be more likely to buy Pounds, which could increase the value of the Pound relative to the Dollar. Conversely, if investors are pessimistic about the US economy, they may be more likely to sell Dollars, which could decrease the value of the Dollar relative to the Pound.

Other factors, such as central bank actions, commodity prices, and global events, can also impact exchange rates. For example, if the Bank of England were to raise interest rates, the value of the Pound may increase relative to the Dollar. Similarly, if there were to be a global economic downturn, the value of the Pound and Dollar may fluctuate.

Understanding these factors can help individuals and businesses make informed decisions when converting 350 quid to dollars. By staying up-to-date with the latest economic indicators, political events, and market sentiment, you can get the best possible exchange rate and avoid unnecessary losses.

Using Online Currency Converters: A Convenient Option

Converting 350 quid to dollars has never been easier, thanks to the numerous online currency converters available. These tools provide a convenient and efficient way to convert currency, often with competitive exchange rates and lower fees compared to traditional banks.

Popular online currency converters include XE, Oanda, and TransferWise. These platforms offer a range of features, such as real-time exchange rates, currency charts, and conversion calculators. They also provide a secure and reliable way to convert currency, with many platforms offering encryption and secure payment processing.

One of the main benefits of using online currency converters is the ability to compare exchange rates and fees across different platforms. This allows you to find the best deal and avoid unnecessary losses. Additionally, many online currency converters offer a range of payment options, including credit cards, debit cards, and bank transfers.

However, it’s essential to be aware of the limitations and potential fees associated with online currency converters. Some platforms may charge higher fees for certain types of transactions, while others may have limited payment options. It’s crucial to read the terms and conditions carefully and understand the fees and charges before using an online currency converter.

When using an online currency converter to convert 350 quid to dollars, it’s also important to consider the exchange rate and any potential fees. Look for platforms that offer competitive exchange rates and low fees, and be aware of any additional charges that may apply. By doing so, you can ensure a smooth and efficient currency conversion process.

Some popular online currency converters for converting 350 quid to dollars include:

- XE: A popular online currency converter that offers competitive exchange rates and low fees.

- Oanda: A well-established online currency converter that provides real-time exchange rates and a range of payment options.

- TransferWise: A peer-to-peer currency converter that offers competitive exchange rates and low fees, with a focus on transparency and security.

By using an online currency converter, you can convert 350 quid to dollars quickly and efficiently, with minimal hassle and cost.

Bank Exchange Rates: How They Compare to Online Rates

When it comes to converting 350 quid to dollars, one of the most common options is to use a bank. However, bank exchange rates can vary significantly from online rates, and it’s essential to understand the differences and potential fees associated with each.

Bank exchange rates are typically set by the bank itself and can be influenced by a range of factors, including the bank’s own costs, market conditions, and profit margins. While banks can offer a convenient and secure way to convert currency, their exchange rates may not always be the most competitive.

In contrast, online currency converters like XE, Oanda, and TransferWise often offer more competitive exchange rates, as they don’t have the same overhead costs as banks. Additionally, online converters can provide real-time exchange rates, which can be more accurate than bank rates.

However, banks can offer some advantages, such as the ability to convert large amounts of currency, access to a range of currencies, and the security of a traditional banking institution. Additionally, some banks may offer more competitive exchange rates for certain types of transactions, such as business or international transactions.

When comparing bank exchange rates to online rates, it’s essential to consider the following factors:

- Exchange rate: Compare the exchange rate offered by the bank to the online rate. Look for the best rate, taking into account any fees or charges.

- Fees: Check the fees associated with each option, including commission fees, transfer fees, and any other charges.

- Security: Consider the security of each option, including the risk of fraud, theft, or other security breaches.

- Convenience: Think about the convenience of each option, including the ease of use, accessibility, and speed of transaction.

Ultimately, the choice between using a bank or an online currency converter to convert 350 quid to dollars will depend on your individual needs and priorities. By understanding the differences and potential fees associated with each option, you can make an informed decision and get the best possible exchange rate.

Tips for Getting the Best Exchange Rate

When converting 350 quid to dollars, getting the best exchange rate is crucial to minimize losses and maximize gains. Here are some tips to help you get the best exchange rate:

Timing is everything: Keep an eye on exchange rate fluctuations and convert your currency when the rate is in your favor. You can use online tools to track exchange rates and receive alerts when the rate reaches a certain level.

Use the right currency converter: Choose a reputable online currency converter that offers competitive exchange rates and low fees. Some popular options include XE, Oanda, and TransferWise.

Avoid unnecessary fees: Be aware of any fees associated with converting currency, including commission fees, transfer fees, and other charges. Look for converters that offer low or no fees.

Compare rates: Compare exchange rates across different converters and banks to find the best rate. You can use online tools to compare rates and find the best deal.

Consider the margin: Some converters may offer a margin on top of the exchange rate, which can eat into your profits. Look for converters that offer a low or no margin.

Be aware of exchange rate volatility: Exchange rates can fluctuate rapidly, so it’s essential to be aware of the current rate and any potential changes. You can use online tools to track exchange rate volatility and make informed decisions.

By following these tips, you can get the best exchange rate when converting 350 quid to dollars and minimize losses. Remember to always research and compare rates before making a conversion.

Common Mistakes to Avoid When Converting Currency

When converting 350 quid to dollars, it’s essential to avoid common mistakes that can result in unnecessary losses or fees. Here are some common mistakes to avoid:

Using outdated exchange rates: Exchange rates can fluctuate rapidly, so it’s crucial to use the current exchange rate when converting currency. Using an outdated exchange rate can result in inaccurate conversions and potential losses.

Neglecting to factor in fees: Many currency converters and banks charge fees for converting currency, which can eat into your profits. Make sure to factor in these fees when converting 350 quid to dollars to avoid any surprises.

Not comparing rates: Failing to compare exchange rates across different converters and banks can result in missed opportunities for better rates. Always compare rates before making a conversion.

Not considering the margin: Some converters may offer a margin on top of the exchange rate, which can impact your profits. Be aware of any margins and factor them into your conversion.

Not using a reputable converter: Using a reputable and trustworthy converter is essential to avoid any potential scams or losses. Research and compare different converters before making a conversion.

Not keeping track of exchange rate fluctuations: Exchange rates can fluctuate rapidly, so it’s essential to keep track of any changes. Use online tools to track exchange rates and make informed decisions.

By avoiding these common mistakes, you can ensure a smooth and efficient currency conversion process when converting 350 quid to dollars.

Conclusion: Converting 350 Quid to Dollars with Confidence

Converting 350 quid to dollars can seem like a daunting task, but with the right knowledge and tools, it can be a straightforward process. By understanding the concept of exchange rates, using the right currency converter, and avoiding common mistakes, you can ensure a smooth and efficient currency conversion process.

In this article, we’ve covered the basics of exchange rates, including how they fluctuate and what factors influence them. We’ve also provided a step-by-step guide on how to convert 350 GBP to USD, including the current exchange rate. Additionally, we’ve discussed the benefits and limitations of using online currency converters and bank exchange rates.

By following the tips and guidelines outlined in this article, you can get the best exchange rate when converting 350 quid to dollars. Remember to always research and compare rates, use a reputable converter, and avoid unnecessary fees. With the right knowledge and tools, you can convert currency with confidence and avoid any potential losses.

Whether you’re a business owner, traveler, or individual looking to convert currency, this article has provided you with the essential information and tools to do so with confidence. By understanding the complexities of exchange rates and using the right tools, you can ensure a successful and efficient currency conversion process.